Cosmetics market in China

In spite of the ongoing coronavirus pandemic, the Chinese cosmetics market was estimated to have the highest year-on-year growth rate among the five leading global markets. In 2021, China accounted for about half of the Asia-Pacific cosmetics market and more than a fifth of the world cosmetics market. As a result of urbanization, growing disposable income, and social media influence, the beauty and personal care market is facing a burgeoning demand for higher quality, premium brand products. According to a Statista consumer survey in 2022, approximately 28 percent of Chinese consumers preferred to buy luxury or premium cosmetics products, well ahead of their peers in South Korea and Australia.In terms of product segments, skincare products still dominate the cosmetics market in China. A Chinese consumer spends an average of 210 yuan per yuan on skincare products, approximately four-fifths of their total cosmetics spending. While colored cosmetics account for the largest proportion of cosmetics sales globally, makeup is still an upcoming beauty category in China. Colored or decorative cosmetics, which largely include face makeup, started to gain popularity among younger consumers.

China's beauty consumers

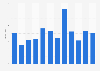

Today, retailing of cosmetic products in China has been dominated by e-commerce. In 2021, more than half of the cosmetics products in China were sold online. Among China's online beauty consumers, Tmall, jd.com, and Taobao were three major e-commerce platforms they used for buying cosmetics products. In recent years, China has witnessed a rapid rise in live streaming, resulting in a growing number of consumers purchasing their beauty supplies via live commerce platforms. In addition, cross-border e-commerce websites and overseas online beauty retailers were also popular among many beauty shoppers in China. In 2021, the direct online cosmetics transaction from South Korea to China was nearly 3.4 trillion South Korean won, which translated to approximately 2.5 billion U.S. dollars.Though most Chinese consumers' appetite for beauty products has a distinctly global flavor, cosmetics with Chinese characteristics have become increasingly popular. Since 2015, domestic cosmetics products have quickly closed the retail sales gap. It is anticipated that the retail sales of local cosmetics brands will surpass international ones by 2024. Three of the most successful ten cosmetics companies in China in 2021 were homegrown. Chinese color cosmetics company Perfect Diary surpassed Dior in 2020 to take the second-largest position in the makeup market.